Davis Bacon Wages: A Georgia Guide

The Davis-Bacon Act, a cornerstone of labor law in the United States, has significant implications for the construction industry, especially within the state of Georgia. This comprehensive guide aims to unravel the complexities of the act, providing a detailed understanding of its impact on wages, working conditions, and the overall construction landscape in Georgia.

Historical Context: The Davis-Bacon Act

Enacted in 1931, the Davis-Bacon Act was a response to the economic challenges of the Great Depression. It aimed to protect local workers from being undercut by contractors employing lower-wage laborers from other states. The act mandated that contractors working on federal public works projects pay their laborers not less than the locally prevailing wage for similar work in the area.

The Davis-Bacon Act was a significant step towards ensuring fair wages and preventing the exploitation of workers, especially during a period of severe economic downturn.

Impact on Georgia’s Construction Industry

In Georgia, the Davis-Bacon Act has a profound effect on the construction sector, influencing wage structures, employment opportunities, and project costs.

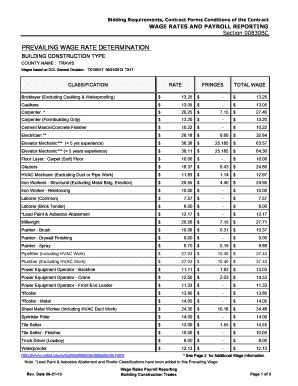

Wage Determinations

The act requires the Department of Labor to set wage determinations for various construction occupations in each state. These determinations are based on surveys of local wages and are critical in ensuring that workers on federal projects receive fair compensation.

Coverage and Exemptions

Not all construction projects in Georgia fall under the purview of the Davis-Bacon Act. It applies to federal contracts for construction, alteration, or repair of public buildings or public works that exceed $2,000. However, there are exemptions for certain projects, such as those funded solely by state or local agencies, and for residential construction with four or fewer units.

Enforcement and Compliance

Ensuring compliance with the Davis-Bacon Act is crucial. Contractors must maintain accurate records of wages paid to each worker, classified by occupation, and make these records available for inspection. Failure to comply can result in significant penalties, including contract termination and debarment from future federal contracts.

Navigating Davis-Bacon Wage Requirements

Understanding the wage requirements under the Davis-Bacon Act is essential for both contractors and laborers.

Determining Prevailing Wages

The prevailing wage, as defined by the act, is the wage paid to the majority of workers in a particular classification within a specific geographic area. It includes both basic hourly rates and fringe benefits, which can include health insurance, vacation pay, and pension contributions.

Wage Classification

Workers are classified into different categories based on their occupation and skill level. These classifications, determined by the Department of Labor, are crucial as they dictate the prevailing wage rate that must be paid to workers in each category.

Recordkeeping and Documentation

Contractors must maintain detailed records of all workers’ wages, hours worked, and classifications. This information is often audited by the Department of Labor to ensure compliance. Accurate recordkeeping is essential to avoid penalties and maintain a good working relationship with federal agencies.

Practical Considerations for Contractors

For contractors operating in Georgia, navigating the Davis-Bacon Act can be complex.

Budgeting and Bid Preparation

When preparing bids for federal projects, contractors must carefully consider the prevailing wage rates. These rates can significantly impact project costs, especially for large-scale public works projects. Accurate budgeting is essential to ensure profitability while complying with the act.

Training and Education

Ensuring that all employees, from project managers to field workers, understand the requirements of the Davis-Bacon Act is crucial. Training programs can help educate staff on the act’s provisions, ensuring compliance and minimizing the risk of penalties.

The Impact on Workers

The Davis-Bacon Act has a direct and positive impact on the wages and working conditions of construction workers in Georgia.

Fair Wages and Benefits

By mandating that workers on federal projects receive prevailing wages, the act ensures that laborers are compensated fairly for their skills and experience. This can lead to increased job satisfaction and improved retention rates.

Enhanced Working Conditions

In addition to wage protections, the Davis-Bacon Act also sets standards for working conditions. It requires contractors to provide safe and healthful working conditions, ensuring that workers are not subjected to hazardous environments.

Future Trends and Developments

As the construction industry evolves, the Davis-Bacon Act will continue to play a critical role in shaping the sector.

Technological Advancements

With the increasing adoption of technology in construction, there may be a need to update the act to address emerging issues. For example, the use of robotics and automation could impact wage structures and classifications.

Changing Labor Dynamics

The construction workforce is evolving, with a greater emphasis on skilled labor and a shift towards a more diverse and inclusive workforce. The Davis-Bacon Act will need to adapt to ensure that it continues to protect workers in this changing landscape.

Conclusion

The Davis-Bacon Act is a complex yet essential piece of legislation that has shaped the construction industry in Georgia and across the United States. By understanding its provisions and impact, contractors, workers, and stakeholders can navigate the construction landscape more effectively, ensuring fair wages, safe working conditions, and compliance with federal regulations.

What is the Davis-Bacon Act and why is it important for Georgia’s construction industry?

+The Davis-Bacon Act is a federal law that mandates the payment of prevailing wages on federal construction projects. In Georgia, it ensures that workers on these projects are paid fair wages, helping to stabilize the construction industry and protect local workers from being undercut by out-of-state contractors.

How are prevailing wages determined under the Davis-Bacon Act in Georgia?

+Prevailing wages are set by the Department of Labor based on surveys of local wages for various construction occupations. These determinations are critical in ensuring that workers receive fair compensation for their skills and experience.

What are the penalties for non-compliance with the Davis-Bacon Act in Georgia?

+Non-compliance with the Davis-Bacon Act can result in severe penalties, including contract termination, debarment from future federal contracts, and civil and criminal liabilities. Contractors must ensure they are aware of and comply with the act’s requirements to avoid these consequences.

How does the Davis-Bacon Act impact the overall construction landscape in Georgia?

+The act has a significant impact on the construction industry in Georgia, influencing wage structures, employment opportunities, and project costs. It ensures fair wages and safe working conditions, contributing to a stable and prosperous construction sector.