Understanding Commercial Building Depreciation Life

Understanding the depreciation life of commercial buildings is crucial for investors, developers, and property owners. It plays a pivotal role in financial planning, tax strategies, and long-term asset management. This comprehensive guide delves into the intricacies of commercial building depreciation, offering insights and real-world examples to illuminate this complex yet vital topic.

The Fundamentals of Commercial Building Depreciation

Depreciation is an accounting and tax concept that recognizes the gradual decline in the value of an asset over its useful life. For commercial buildings, this concept is particularly significant as it impacts tax liabilities, cash flow, and the overall financial health of a property.

The Internal Revenue Service (IRS) in the United States recognizes two primary methods for depreciating commercial real estate: straight-line depreciation and modified accelerated cost recovery system (MACRS). Each method has its advantages and is applicable to different situations.

Straight-Line Depreciation

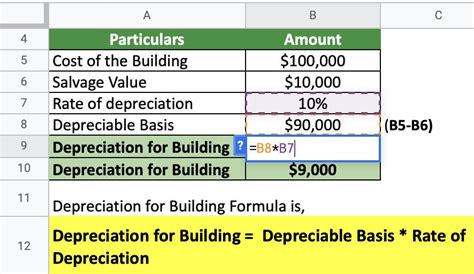

Straight-line depreciation is the simplest and most commonly used method. It assumes that an asset loses value at a steady rate over its useful life. The depreciation expense is calculated by dividing the asset’s cost by its useful life. For commercial buildings, the useful life is typically determined by the IRS and can vary based on the type of property and its intended use.

| Asset Type | Useful Life (Years) |

|---|---|

| Commercial Buildings | 39 |

| Residential Buildings | 27.5 |

| Equipment and Furnishings | Varies (5-7 years) |

For instance, if a commercial building has a cost basis of $10 million and a useful life of 39 years, the annual depreciation expense would be $256,410 ($10 million / 39 years). This method provides a consistent and predictable depreciation schedule, making financial planning easier.

Modified Accelerated Cost Recovery System (MACRS)

MACRS is a more complex depreciation method that allows for accelerated depreciation in the early years of an asset’s life. It offers higher depreciation deductions in the initial years, which can be beneficial for reducing tax liabilities and improving cash flow. However, the depreciation expense tapers off as the asset ages.

The MACRS system uses a series of declining balance rates and salvage values to calculate depreciation. The rates and lives are predetermined by the IRS and depend on the asset class.

| Asset Class | Depreciation Method | Recovery Period (Years) |

|---|---|---|

| 39-Year Property | 200% Declining Balance | 39 |

| 27.5-Year Property | 200% Declining Balance | 27.5 |

| 5-Year Property | 200% Declining Balance | 5 |

| 7-Year Property | 150% Declining Balance | 7 |

In the case of a 39-year commercial building, the MACRS depreciation method would provide higher depreciation deductions in the first years, which could be a significant tax benefit for property owners.

Factors Influencing Commercial Building Depreciation

The depreciation life of a commercial building is influenced by several factors, each of which can significantly impact the overall financial picture.

Building Type and Use

The IRS recognizes different depreciation lives for various types of commercial buildings. For example, a retail store might have a shorter useful life than an office building due to potential wear and tear from high foot traffic. Similarly, a warehouse might have a different useful life depending on the nature of the goods stored and the associated wear on the structure.

Location and Environmental Factors

The geographic location of a commercial building can impact its depreciation life. Buildings in areas with harsh weather conditions or high seismic activity may have shorter useful lives due to increased wear and the need for more frequent maintenance or repairs.

Maintenance and Upkeep

Proper maintenance and regular upkeep can extend the useful life of a commercial building. Well-maintained properties may have a longer depreciation life, as they are less likely to experience premature wear and tear. Conversely, neglecting maintenance can lead to accelerated depreciation as the building deteriorates faster.

Market Conditions and Property Value

Market conditions and property value fluctuations can also impact depreciation. In a robust real estate market, a property’s value may increase, which can affect the calculation of depreciation. Conversely, in a declining market, the value of the property may decrease, potentially leading to a reassessment of the useful life and depreciation schedule.

Financial Implications and Tax Strategies

Understanding commercial building depreciation is critical for effective financial planning and tax strategies. Depreciation deductions can significantly impact a property owner’s tax liability and cash flow.

Tax Benefits of Depreciation

Depreciation is a non-cash expense, meaning it reduces a property owner’s taxable income without requiring an actual cash outlay. This can result in substantial tax savings, especially when using accelerated depreciation methods like MACRS.

For example, if a property owner has a commercial building with a cost basis of $5 million and uses the MACRS depreciation method, they could potentially reduce their taxable income by several hundred thousand dollars annually, depending on the building's age and the specific depreciation schedule.

Tax Considerations for Property Sales

Depreciation can also impact the tax implications of a property sale. When a commercial building is sold, the accumulated depreciation is added back to the cost basis to determine the gain or loss on the sale. This can result in a higher tax liability if the property has been fully depreciated or a lower tax liability if depreciation has been accelerated.

Maximizing Depreciation Benefits

Property owners can take several steps to maximize the depreciation benefits of their commercial buildings. These include:

- Regular maintenance and upkeep to extend the useful life of the building.

- Keeping detailed records of maintenance and repairs to support the depreciation schedule.

- Engaging in cost segregation studies to identify assets with shorter useful lives and potentially increase depreciation deductions.

- Consulting with tax professionals to ensure compliance with IRS guidelines and to optimize tax strategies.

Future Implications and Long-Term Planning

Understanding the depreciation life of a commercial building is not just about the here and now. It’s a crucial aspect of long-term financial planning and asset management.

Planning for Future Renovations and Upgrades

Knowing the depreciation life of a commercial building can help property owners plan for future renovations and upgrades. If a building is nearing the end of its useful life, it may be more cost-effective to consider a major renovation or even a complete overhaul rather than continuing with incremental repairs.

Long-Term Asset Management and Replacement

Depreciation is an essential factor in long-term asset management. Property owners can use the depreciation schedule to plan for the eventual replacement of their commercial buildings. By setting aside funds over time, they can ensure they have the financial resources available when the time comes to replace the asset.

Strategic Investment Decisions

Depreciation can also influence investment decisions. When considering the purchase of a commercial property, potential buyers can use the depreciation schedule to assess the financial health of the asset and plan for potential repairs or upgrades. This information can be invaluable in negotiating the purchase price and making informed investment decisions.

Frequently Asked Questions

Can I change the depreciation method for my commercial building mid-way through its useful life?

+Changing depreciation methods mid-way is generally not recommended and may require IRS approval. It’s best to consult a tax professional for specific guidance on changing depreciation methods.

How does depreciation affect the cash flow of a commercial property?

+Depreciation is a non-cash expense, so it reduces taxable income without requiring an actual cash outlay. This can result in increased cash flow for property owners, especially when using accelerated depreciation methods.

What is cost segregation and how does it impact depreciation?

+Cost segregation is a process that identifies and separates the various components of a building with different useful lives. This can potentially increase depreciation deductions by recognizing shorter-lived assets separately.