7 Key Strategies for the CFA Level 1 Exam

As a seasoned professional in the financial industry with extensive experience in teaching and mentoring, I've seen firsthand the impact that effective preparation strategies can have on aspiring Chartered Financial Analysts (CFAs). The CFA Level 1 Exam is a rigorous assessment that demands a comprehensive understanding of various financial concepts and principles. In this article, we will delve into seven essential strategies to help you tackle this challenging exam with confidence and success.

1. Understanding the CFA Level 1 Exam Structure

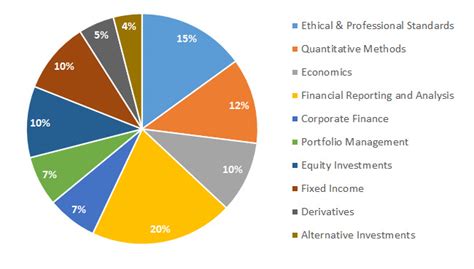

Grasping the fundamentals of the exam structure is crucial for a well-rounded preparation strategy. The CFA Level 1 Exam consists of two sessions, each lasting three hours, with a total of 180 multiple-choice questions. These questions cover ten distinct topic areas, including ethical and professional standards, quantitative methods, economics, financial reporting and analysis, corporate finance, equity investments, fixed income, derivatives, alternative investments, and portfolio management.

Each topic area carries a specific weightage in the exam, with some topics having a higher impact on your overall score. For instance, ethics and quantitative methods are typically given more prominence, while alternative investments may have a lower weightage. Understanding this structure allows you to allocate your study time effectively and focus on the areas that carry the most significance.

Tips for Efficient Study:

- Create a study plan that dedicates more time to the heavily weighted topics, ensuring a balanced approach.

- Utilize practice questions and mock exams to assess your understanding of each topic area.

- Stay updated with the latest exam curriculum and any changes in the topic weightages.

2. Building a Solid Foundation with Ethical and Professional Standards

The CFA Institute places significant emphasis on ethical and professional standards, considering them as the cornerstone of the CFA Program. As such, a strong foundation in this area is essential for your success in the Level 1 Exam. Understanding the CFA Institute Code of Ethics and Standards of Professional Conduct is crucial, as it forms the basis for many exam questions and demonstrates your commitment to upholding ethical practices in the financial industry.

Strategies for Ethical Preparation:

- Study the CFA Institute Code of Ethics thoroughly, ensuring a deep understanding of its principles and application.

- Practice ethical dilemma scenarios to enhance your critical thinking skills and decision-making abilities.

- Stay informed about recent ethical controversies and debates in the financial world, as these can provide valuable insights for exam preparation.

3. Mastering Quantitative Methods and Financial Mathematics

Quantitative methods and financial mathematics form a significant portion of the Level 1 Exam, encompassing topics such as time value of money, rates of return, and risk and return calculations. A strong grasp of these concepts is essential for your success, as they provide the foundation for many financial analysis techniques.

To excel in this area, it is crucial to develop a systematic approach to solving mathematical problems. Practice is key, and you should aim to solve a diverse range of questions to enhance your problem-solving skills and speed.

Quantitative Study Tips:

- Create a dedicated study plan for quantitative methods, ensuring regular practice.

- Utilize online resources and practice questions to sharpen your mathematical skills.

- Break down complex problems into simpler steps to enhance your understanding and problem-solving ability.

- Review common mathematical formulas and their applications regularly.

4. Exploring Economics and Global Perspectives

The Level 1 Exam covers a broad range of economic concepts, including microeconomics, macroeconomics, and global economic conditions. A comprehensive understanding of these topics is essential, as they provide the context for many financial decisions and strategies.

To excel in this area, it is beneficial to stay updated with current economic events and trends. Following reputable economic news sources and analyzing economic data can help you connect theoretical concepts with real-world applications, enhancing your understanding and retention.

Economic Study Strategies:

- Allocate dedicated study time for economics, ensuring a thorough understanding of key concepts.

- Stay informed about current economic policies, trends, and events to apply theoretical knowledge to real-world scenarios.

- Practice interpreting economic data and analyzing its implications for financial decisions.

5. Financial Reporting and Analysis: A Critical Skill

Financial reporting and analysis is a crucial aspect of the Level 1 Exam, as it forms the basis for many financial decisions. Understanding financial statements, ratios, and analysis techniques is essential for interpreting a company’s financial health and performance.

To excel in this area, it is beneficial to practice interpreting and analyzing financial statements from various industries. This not only enhances your understanding of financial reporting concepts but also improves your ability to apply these concepts to real-world scenarios.

Financial Reporting Study Tips:

- Study financial reporting concepts thoroughly, ensuring a clear understanding of the underlying principles.

- Practice interpreting financial statements from different industries to enhance your analytical skills.

- Familiarize yourself with common financial ratios and their applications in financial analysis.

6. The Fundamentals of Corporate Finance

Corporate finance is a critical topic in the Level 1 Exam, covering areas such as capital budgeting, cost of capital, and capital structure. A solid understanding of these concepts is essential for your success, as they form the foundation for many financial decisions made by corporations.

To excel in corporate finance, it is beneficial to develop a systematic approach to problem-solving. Practice is key, and you should aim to solve a variety of corporate finance questions to enhance your understanding and speed.

Corporate Finance Study Strategies:

- Create a dedicated study plan for corporate finance, ensuring a comprehensive understanding of key concepts.

- Utilize practice questions and case studies to apply theoretical knowledge to real-world corporate finance scenarios.

- Review common corporate finance formulas and their applications regularly.

7. Investing in Equity and Fixed Income Markets

The Level 1 Exam covers a wide range of investment topics, including equity and fixed income investments. Understanding these markets and their unique characteristics is essential for making informed investment decisions.

To excel in this area, it is beneficial to develop a practical understanding of investment strategies and their applications. Following reputable investment news sources and analyzing market trends can help you connect theoretical concepts with real-world investment scenarios, enhancing your understanding and retention.

Investment Study Tips:

- Study investment concepts thoroughly, ensuring a clear understanding of different investment vehicles and their risks.

- Practice analyzing investment options and evaluating their suitability for different investment objectives.

- Stay informed about current market trends and investment strategies to apply theoretical knowledge to real-world scenarios.

Conclusion: A Well-Prepared Journey to CFA Success

The CFA Level 1 Exam is a challenging yet rewarding milestone in your financial career. By implementing these seven key strategies, you can approach the exam with confidence and a solid foundation of knowledge. Remember, effective preparation is a journey, and consistent effort and dedication are key to your success.

Stay focused, stay committed, and embrace the challenges that the Level 1 Exam presents. With a well-rounded understanding of the exam structure, a solid foundation in ethical standards, and a practical approach to financial concepts, you’ll be well on your way to achieving your CFA goals.

What is the passing rate for the CFA Level 1 Exam?

+The passing rate for the CFA Level 1 Exam varies each year but typically hovers around 40-45%. However, with effective preparation and a solid understanding of the concepts, you can significantly increase your chances of success.

How many hours should I study for the Level 1 Exam?

+The recommended study time for the Level 1 Exam is approximately 300 hours. However, the actual study time required may vary based on your prior knowledge and learning style. It’s essential to create a personalized study plan that suits your needs.

Are there any recommended study materials for the Level 1 Exam?

+The CFA Institute provides official study materials, including the CFA Program Curriculum, Candidate Resources, and Practice Exams. Additionally, there are reputable third-party resources available, such as Kaplan Schweser and AnalystNotes, which offer comprehensive study packages.