Unveiling Consumer Surplus: 3 Key Steps

Understanding Consumer Surplus

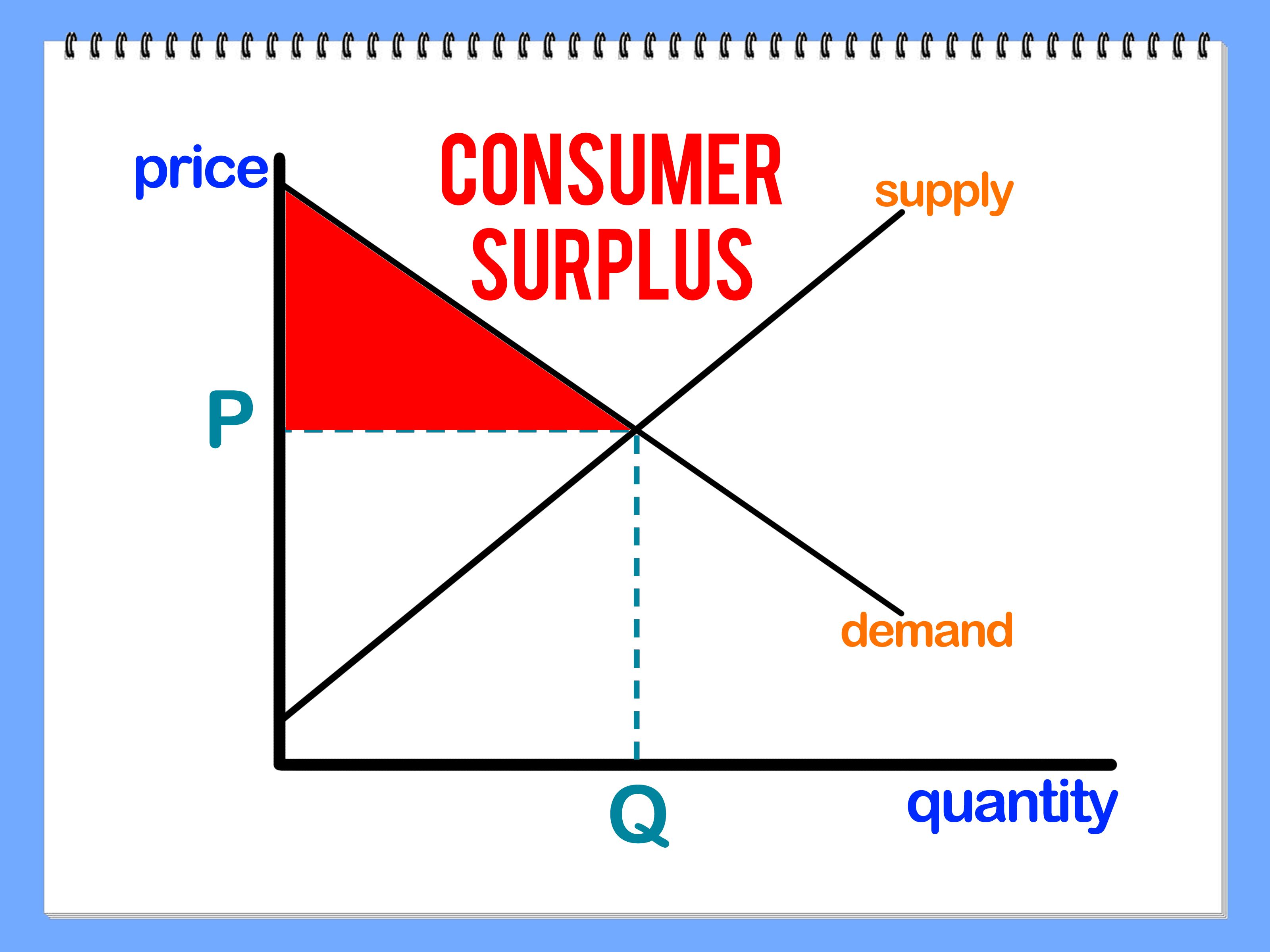

Consumer surplus is the difference between what consumers are willing to pay for a good or service and the price they actually pay. It represents the extra value or satisfaction that consumers gain from their purchases. This concept is particularly relevant when examining competitive markets, where prices are driven by supply and demand.

Imagine a simple scenario: a consumer is willing to pay up to 100 for a concert ticket, but the market price is only 75. The consumer surplus in this case is $25, as the consumer gains additional satisfaction or utility beyond the price paid. This surplus is a key measure of consumer welfare and is often used to evaluate the impact of policies and market interventions.

Step 1: Determining Willingness to Pay

The first step in calculating consumer surplus is understanding the consumer’s willingness to pay. This involves analyzing consumer behavior and preferences.

- Demand Curves: These curves illustrate the relationship between price and quantity demanded. By examining the demand curve, economists can identify the maximum price consumers are willing to pay for different quantities of a good.

- Consumer Surveys: Surveys can provide valuable insights into consumer preferences and their perceived value of goods or services. This method is particularly useful when dealing with unique or intangible products.

- Market Research: Conducting extensive market research can help businesses and analysts understand consumer behavior and preferences. This may involve focus groups, interviews, and analyzing sales data.

For instance, consider the market for luxury cars. By studying the demand curve, economists can identify the price point at which consumers are willing to purchase a certain number of luxury vehicles. This data is crucial for calculating consumer surplus and understanding the overall value consumers derive from their purchases.

Step 2: Analyzing Market Prices

The second step involves gathering and analyzing market price data. This step is essential to understand the actual price consumers pay for goods or services.

- Market Monitoring: Regularly monitoring market prices is crucial. This can be done through price tracking software or by analyzing sales data. By staying updated on market prices, analysts can accurately calculate consumer surplus.

- Historical Price Analysis: Examining historical price trends provides valuable context. It allows economists to identify price fluctuations and understand the impact of supply and demand on consumer surplus over time.

- Comparative Pricing: Comparing prices across different markets or regions can highlight variations in consumer surplus. This analysis can reveal opportunities for businesses to expand into new markets or adjust pricing strategies.

Let’s consider the smartphone market. By analyzing market prices, economists can identify the average price consumers pay for different smartphone models. This data, combined with willingness-to-pay information, allows for a more precise calculation of consumer surplus in the smartphone industry.

Step 3: Calculating Consumer Surplus

The final step involves using the data gathered in the previous steps to calculate consumer surplus. There are various methods to calculate consumer surplus, depending on the available data and the nature of the market.

Method Selection

- Area under the Demand Curve: For markets with stable prices, calculating the area under the demand curve up to the equilibrium price provides an accurate estimate of consumer surplus.

- Integration: In cases where the demand curve is represented by a mathematical function, integration can be used to calculate consumer surplus. This method is particularly useful for continuous demand curves.

- Willingness-to-Pay Surveys: When direct surveys are conducted to determine willingness to pay, the difference between the maximum willingness to pay and the actual price paid can be summed up to calculate consumer surplus.

Case Study: Consumer Surplus in the Online Gaming Industry

The online gaming industry provides an excellent example of consumer surplus calculation. By analyzing player behavior and in-game purchases, economists can determine the willingness to pay for different in-game items or experiences. Combining this data with market prices allows for an accurate estimation of consumer surplus in the online gaming market.

Conclusion: Unlocking the Benefits of Consumer Surplus

Understanding consumer surplus is vital for businesses, as it provides insights into consumer behavior and the overall value of their products. By calculating consumer surplus, companies can make informed decisions regarding pricing strategies, product development, and market expansion.

How does consumer surplus impact businesses?

+Consumer surplus provides valuable insights for businesses. By understanding the surplus, companies can identify areas where they can improve customer satisfaction and loyalty. Additionally, it helps businesses set optimal prices, ensuring profitability while maximizing consumer welfare.

Can consumer surplus be negative?

+Yes, consumer surplus can be negative in certain scenarios. For instance, if a market experiences a sudden increase in demand, prices may rise above the willingness to pay, resulting in a negative consumer surplus. This situation is often temporary and can be addressed through market adjustments.

How does consumer surplus differ from producer surplus?

+Consumer surplus and producer surplus are two sides of the same coin. While consumer surplus measures the benefits consumers gain, producer surplus measures the benefits producers receive from selling their goods or services. Together, they represent the overall welfare gains in a market.

What are the limitations of consumer surplus calculation?

+Consumer surplus calculation relies on accurate data and assumptions. Limitations include the challenge of accurately measuring willingness to pay and the potential for changes in consumer preferences over time. Additionally, dynamic markets may require frequent updates to consumer surplus calculations.