1099 Software: Streamlining Your Accounting Practice

In the ever-evolving landscape of the accounting industry, technology has become an indispensable ally, revolutionizing the way professionals manage their practice. Among the myriad of tools available, 1099 software stands out as a powerful instrument for streamlining accounting processes, enhancing efficiency, and ultimately, boosting the success of your practice.

This comprehensive guide delves into the world of 1099 software, exploring its features, benefits, and impact on modern accounting practices. We will uncover how this innovative technology can transform your workflow, improve client relationships, and elevate your practice to new heights.

Unraveling the Potential of 1099 Software

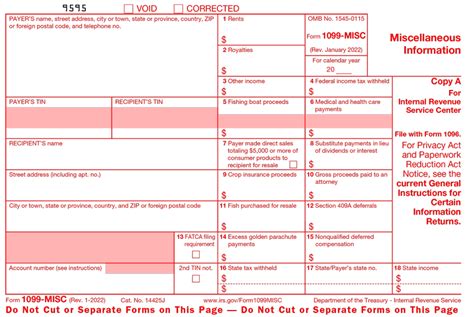

At its core, 1099 software is a specialized accounting tool designed to simplify the process of filing and managing Information Returns, particularly those related to non-employee compensation and miscellaneous income. These returns are a crucial aspect of tax compliance for businesses, as they ensure accurate reporting of payments made to independent contractors and other non-employee workers.

The traditional method of handling 1099 forms involves a myriad of manual tasks, from data entry to printing, mailing, and record-keeping. This process is not only time-consuming but also prone to errors, especially when dealing with large volumes of information. This is where 1099 software steps in, offering a digital solution to streamline and automate these processes, making them more efficient, accurate, and cost-effective.

Key Features of 1099 Software

1099 software comes equipped with a suite of features tailored to the unique needs of accounting professionals. These include:

- Intuitive Data Entry: User-friendly interfaces make it easy to input information, reducing the likelihood of errors and saving valuable time.

- Automated Form Generation: The software generates 1099 forms automatically, ensuring accuracy and eliminating the need for manual form creation.

- Electronic Filing: Many 1099 software platforms offer the ability to file forms electronically, streamlining the submission process and reducing paper waste.

- E-Delivery: With the option for electronic delivery, you can send 1099 forms directly to recipients, cutting down on printing and mailing costs.

- Robust Record-Keeping: The software maintains a digital record of all filed forms, providing easy access to historical data and ensuring compliance with record-keeping requirements.

- Integration with Accounting Software: Advanced 1099 software integrates seamlessly with popular accounting platforms, enabling a smooth flow of data and enhancing overall efficiency.

By leveraging these features, accounting professionals can significantly reduce the time and resources dedicated to 1099 form management, allowing them to focus more on strategic aspects of their practice.

Enhancing Efficiency with 1099 Software

One of the most significant advantages of 1099 software is its ability to boost efficiency in accounting practices. The software automates repetitive tasks, freeing up time for professionals to concentrate on higher-value activities. For instance, instead of manually entering data into forms and managing paper records, accountants can utilize this time to provide more insightful financial advice to their clients or delve deeper into complex accounting matters.

Moreover, 1099 software often includes built-in checks and balances, reducing the risk of errors and ensuring compliance with tax regulations. This not only saves time on potential audits and corrections but also enhances the reputation of the accounting practice by demonstrating a high level of accuracy and professionalism.

The software's efficient data management capabilities also facilitate better decision-making. With real-time access to accurate information, accountants can quickly analyze trends, identify areas for improvement, and make strategic recommendations to their clients. This proactive approach not only strengthens client relationships but also positions the accounting practice as a trusted advisor, not just a number-cruncher.

Real-World Example: Time and Cost Savings

Consider a medium-sized accounting firm that traditionally managed 1099 forms manually. With a client base of 500 businesses, each requiring an average of 20 1099 forms, the firm would need to process and file 10,000 forms annually. This process involved significant time and resources, with a team of 3 dedicated employees working for 3 months solely on this task.

By implementing 1099 software, the firm achieved remarkable results. The software reduced the time required to process and file forms by 70%, allowing the team to complete the task in just 2 months. Additionally, the firm saved approximately $15,000 annually on printing, mailing, and labor costs. This efficiency gain not only improved the firm's bottom line but also allowed them to redirect resources towards business development and client engagement, ultimately enhancing their competitive advantage.

Improving Client Relationships with 1099 Software

Client relationships are the lifeblood of any accounting practice. By implementing 1099 software, accountants can significantly enhance these relationships through improved communication, faster turnaround times, and a more personalized service.

The software's automated features enable accountants to deliver 1099 forms to clients more swiftly and accurately. This not only ensures compliance but also reduces the administrative burden on clients, who often appreciate the simplicity and convenience of digital processes.

Furthermore, 1099 software allows accountants to provide a more comprehensive service. With the time saved from manual tasks, accountants can offer additional value-added services, such as tax planning, financial analysis, or consulting on business growth strategies. This proactive approach demonstrates a deeper commitment to client success, fostering stronger and more loyal client relationships.

Personalized Service and Client Satisfaction

1099 software also empowers accountants to tailor their services to individual client needs. By leveraging the software's data management capabilities, accountants can gain valuable insights into each client's financial landscape. This enables them to provide personalized advice and solutions, enhancing client satisfaction and loyalty.

For instance, the software can highlight clients who consistently receive payments from a particular source, which might indicate an opportunity for further business development or tax optimization. By recognizing these patterns, accountants can offer tailored advice, strengthening their relationship with the client and positioning themselves as a trusted advisor.

Future Implications and Industry Trends

As technology continues to advance, the role of 1099 software in the accounting industry is set to become even more significant. The software is expected to evolve further, integrating with other accounting tools and offering more advanced analytics and reporting capabilities.

One emerging trend is the integration of 1099 software with blockchain technology. This integration could revolutionize the way information returns are filed, ensuring a higher level of security and transparency. Blockchain's distributed ledger system could provide an immutable record of 1099 forms, reducing the risk of fraud and enhancing overall trust in the process.

Another area of development is the use of artificial intelligence (AI) within 1099 software. AI-powered analytics could provide more advanced insights into financial data, enabling accountants to make even more strategic recommendations to their clients. This could include identifying potential tax savings, optimizing business operations, or predicting future financial trends.

Staying Ahead in a Competitive Landscape

In the highly competitive world of accounting, staying ahead of the curve is crucial. By embracing 1099 software and leveraging its capabilities, accounting practices can differentiate themselves from their competitors. The efficiency gains, enhanced client relationships, and strategic insights offered by the software can provide a significant competitive advantage, attracting new clients and retaining existing ones.

As the accounting industry continues to evolve, those who adapt to technological advancements like 1099 software will be well-positioned for success. By streamlining processes, improving client service, and harnessing the power of data, accounting professionals can elevate their practice to new heights, offering a level of service that sets them apart.

FAQs

What is a 1099 form, and why is it important for businesses?

+A 1099 form is a tax document used to report various types of income, including non-employee compensation, interest, dividends, and other income. It’s crucial for businesses as it ensures compliance with tax regulations and helps maintain accurate financial records.

How does 1099 software enhance the efficiency of accounting practices?

+1099 software automates the process of generating and filing 1099 forms, reducing manual tasks and potential errors. This efficiency gain allows accountants to focus more on strategic activities, client engagement, and value-added services.

What are the key benefits of using 1099 software for accounting professionals?

+The key benefits include streamlined data entry, automatic form generation, electronic filing and delivery, robust record-keeping, and seamless integration with other accounting software. These features improve efficiency, accuracy, and compliance, while also enhancing client relationships and providing strategic insights.

How can 1099 software improve client relationships in accounting practices?

+By using 1099 software, accountants can deliver faster and more accurate services, reducing the administrative burden on clients. The software also enables accountants to offer more personalized advice and value-added services, strengthening client relationships and loyalty.