10 Easy Steps to the 2024 1099 Deadline

The 1099 filing deadline is an important milestone for businesses and independent contractors, and proper preparation can make the process smoother. Here, we outline a straightforward ten-step guide to help you navigate the 2024 1099 filing process efficiently and ensure compliance with tax regulations.

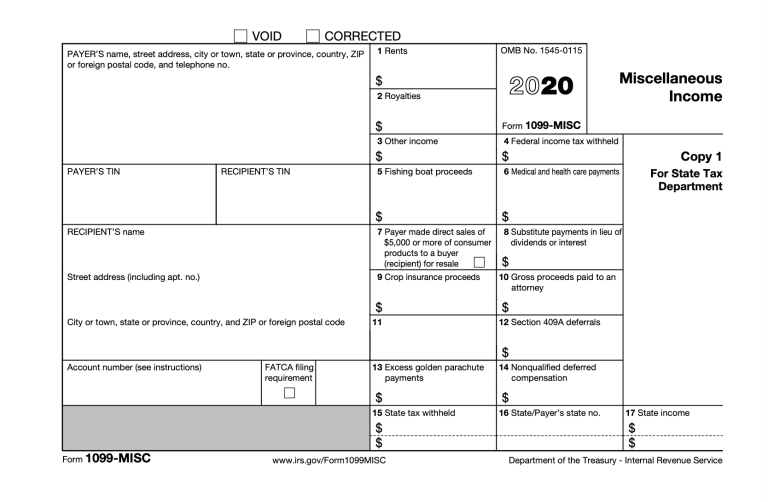

Understand the 1099 Forms and Their Purposes:

- 1099 forms are used to report various types of income to the IRS, such as rental income, interest, dividends, and payments to independent contractors.

- Familiarize yourself with the different types of 1099 forms, including 1099-MISC (Miscellaneous Income), 1099-NEC (Non-Employee Compensation), 1099-INT (Interest Income), and others. Each form serves a specific purpose, so understanding which form to use for different transactions is crucial.

Gather Relevant Information:

- Collect all necessary information, including your business’s EIN (Employer Identification Number), names, addresses, and taxpayer identification numbers (TINs) of recipients, and the amounts paid to them during the tax year.

- Ensure the accuracy of the data, as errors can lead to penalties and delays.

Determine Filing Requirements:

- Research and understand the filing requirements for your business. The rules may vary based on the number of payments made, the type of payments, and the recipient’s status.

- For example, if you paid an independent contractor more than $600 in a year, you generally need to issue a 1099-NEC. However, there may be exceptions or additional forms required in certain circumstances.

Prepare and Send 1099 Forms to Recipients:

- Complete the 1099 forms accurately, ensuring that all fields are filled in correctly.

- Send the forms to the recipients by January 31, 2024 (or the next business day if the 31st falls on a weekend or holiday). This gives them time to review and report the income on their tax returns.

File Copies of 1099 Forms with the IRS:

- After sending the forms to recipients, you must file copies with the IRS. The due date for filing with the IRS is also January 31, 2024.

- You can file electronically using the IRS’s online filing system or mail the forms to the appropriate IRS center.

Keep Records for Future Reference:

- Maintain copies of all filed 1099 forms and related records for at least four years. These records can be crucial in case of an audit or if there are any discrepancies in the future.

Consider Using Tax Preparation Software:

- To streamline the process, consider using tax preparation software that specializes in 1099 filings. These tools can automate many tasks, such as form completion, e-filing, and record-keeping.

Stay Informed About Updates and Changes:

- Keep yourself updated on any changes or updates to the 1099 filing process. The IRS may introduce new forms, change filing requirements, or offer guidance on specific scenarios.

Seek Professional Assistance if Needed:

- If you’re unsure about any aspect of the 1099 filing process or have complex transactions, consult a tax professional or accountant. They can provide expert advice and ensure compliance with the latest regulations.

Plan Ahead for Future Filings:

- Start preparing for the next tax season early. By staying organized and keeping records throughout the year, you can make the filing process easier and less stressful.

By following these ten steps, you can efficiently and accurately meet the 2024 1099 filing deadline, ensuring compliance with tax regulations and maintaining good financial records.

What is the penalty for missing the 1099 filing deadline?

+Missing the 1099 filing deadline can result in penalties. The IRS imposes penalties for late filing, ranging from 50 to 270 per form, depending on the circumstances and whether the failure was intentional. It’s important to note that these penalties can add up quickly, especially if you have multiple forms to file. To avoid penalties, it’s best to plan and file your 1099s on time.

Can I file 1099 forms electronically?

+Yes, you can file 1099 forms electronically through the IRS’s online filing system. Electronic filing is a convenient and efficient way to meet your filing obligations. It eliminates the need for mailing paper forms and reduces the risk of errors or delays. The IRS provides detailed instructions and resources to guide you through the electronic filing process.

Are there any exceptions to the 1099 filing requirements?

+Yes, there are certain exceptions to the 1099 filing requirements. For instance, you may not have to issue a 1099-NEC if the payment was made to a corporation or if the payment was for services provided outside the United States. Additionally, there are exceptions for certain types of payments, such as payments made to attorneys or payments for medical and health care services. It’s important to research and understand these exceptions to ensure compliance.

How can I ensure the accuracy of the information on my 1099 forms?

+Ensuring the accuracy of your 1099 forms is crucial. To achieve this, verify the recipient’s name, address, and taxpayer identification number (TIN) before filing. Cross-check the information with your records and the recipient’s W-9 form. Double-check the amounts paid and ensure they match your records. By taking these steps, you can minimize the risk of errors and potential penalties.

What if I discover an error on a previously filed 1099 form?

+If you discover an error on a previously filed 1099 form, it’s important to correct it promptly. The IRS provides guidance on how to handle such situations. Generally, you need to file a corrected 1099 form using the appropriate codes to indicate the correction. It’s crucial to notify the recipient of the correction and ensure they update their records accordingly. Failure to correct errors can lead to penalties and complications in tax reporting.