Last-Minute Tips for 1099s in 2024

Navigating the Last-Minute Crunch for 1099s

As we approach the tax season, many independent contractors, freelancers, and businesses are scrambling to ensure they meet the deadline for their 1099 forms. The 1099 series of tax forms are a crucial part of the US tax system, designed to report various types of income and expenses. While some might have their finances in order well ahead of time, others find themselves in a last-minute rush. So, if you’re one of those individuals feeling the pressure, here’s a comprehensive guide to help you navigate this hectic period.

Step 1: Gather All Relevant Information

The first step in the last-minute 1099 preparation is to gather all the necessary documents and information. This includes all your income sources, such as client invoices, payment records, and any other proof of income. Additionally, collect any relevant expenses, such as business-related travel, equipment purchases, or professional services. Ensure you have accurate and detailed records to support your claims.

Step 2: Determine the Right 1099 Form

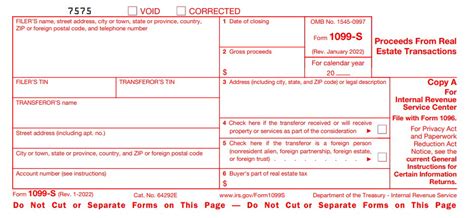

The 1099 series comprises various forms, each catering to different types of income. Some common forms include 1099-NEC for non-employee compensation, 1099-MISC for miscellaneous income, and 1099-K for payment card and third-party network transactions. Understand which form applies to your situation and ensure you have the correct one. Misidentification can lead to errors and potential penalties.

For instance, if you've received income from a client through a payment app, you might need to use the 1099-K form. However, if you've been paid through traditional means, such as a check or direct deposit, the 1099-NEC would be more appropriate.

Step 3: Calculate Your Income and Expenses

Once you have all your documents in order, it's time to calculate your income and expenses. This is a critical step, as it determines your taxable income and the deductions you can claim. Use reliable accounting software or consult a tax professional to ensure accuracy. Don't forget to consider any potential adjustments, such as depreciation or amortization, which can impact your tax liability.

For example, if you've purchased equipment for your business, you might be eligible for a depreciation deduction. This can reduce your taxable income and lower your overall tax burden.

Step 4: File Your 1099s

With your calculations complete, it's time to file your 1099s. The deadline for filing varies depending on the form and whether you're filing electronically or by mail. Generally, the deadline is January 31st, but it's always best to check the official IRS website for the most up-to-date information.

If you're filing electronically, ensure you have the necessary software and follow the instructions carefully. For paper filings, make sure you use the correct address and allow sufficient time for delivery.

Remember, filing late can result in penalties, so it's crucial to get your forms in on time.

Step 5: Prepare for Potential Audits

While no one wants to think about audits, it's important to be prepared. If you've filed your 1099s at the last minute, there's a chance the IRS might take a closer look at your returns. Ensure you have all your supporting documentation readily available in case of an audit. This includes bank statements, receipts, and any other records that substantiate your income and expenses.

Being organized and having a clear paper trail can make the audit process less stressful and increase the chances of a positive outcome.

Pros and Cons of Last-Minute Filing

- Pros:

- You might catch errors or overlooked deductions that could save you money.

- The process can be less overwhelming if you have a straightforward tax situation.

- It can motivate you to get your finances in order quickly.

- Cons:

- Increased stress and potential for errors.

- Limited time to seek professional advice if needed.

- Risk of penalties for late filing or incorrect information.

"The key to successful last-minute 1099 preparation is organization and a methodical approach. Ensure you have a clear understanding of your financial situation and don't hesitate to seek professional help if you're unsure." - John Carter, CPA

Can I file for an extension for my 1099s?

+Yes, you can file for an extension, but it's important to note that an extension only extends the time to file, not the time to pay any taxes due. You must still pay your estimated taxes by the original deadline to avoid penalties. To file for an extension, use Form 4868.

What happens if I miss the 1099 deadline?

+Missing the deadline can result in penalties. The IRS imposes a penalty of $50 for each late-filed 1099, up to a maximum of $1,130,250 per year. It's crucial to file on time to avoid these penalties.

Can I e-file my 1099s if I'm a small business owner or freelancer?

+Absolutely! E-filing is not only convenient but also more secure and efficient. Many reputable online tax preparation services offer e-filing options for 1099s. Just ensure you choose a reputable service and have all your information ready.

Are there any common mistakes to avoid when filing 1099s at the last minute?

+Some common mistakes to avoid include incorrect taxpayer identification numbers, miscalculations, and overlooking potential deductions. Always double-check your work and consider seeking professional advice if you're unsure.

While last-minute 1099 preparation can be stressful, with the right approach and attention to detail, you can ensure a smooth filing process. Remember, organization, accuracy, and timely filing are key to avoiding penalties and ensuring a positive tax experience.