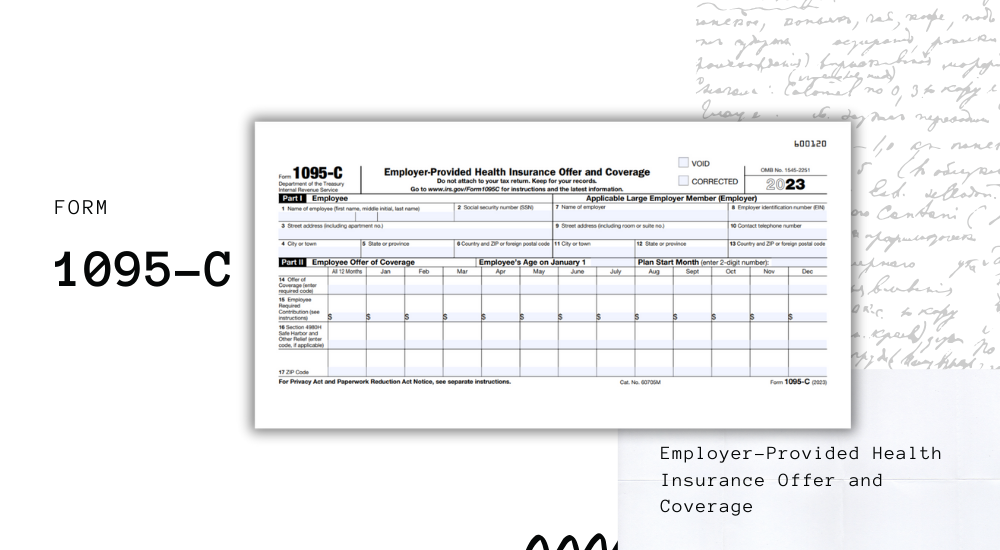

Unraveling the 1095-C Form: A Step-by-Step Guide

The 1095-C form is a critical document for employers and employees alike, as it reports on the offer of affordable healthcare coverage. This intricate form is part of the Affordable Care Act’s reporting requirements, ensuring compliance and providing valuable information for tax purposes. Let’s dive into a comprehensive, step-by-step guide to understanding and completing this essential document.

Understanding the Basics

The 1095-C form is a multi-part document, with Parts I, II, and III serving different purposes. Part I is where the employer provides essential information about the company and its offer of health coverage. Part II delves into the specifics of the health plans offered, including the cost and the employees enrolled. Part III is where the employer certifies the accuracy of the information provided.

Step 1: Gathering Necessary Information

Before you begin filling out the form, gather all the necessary details. This includes the employer’s EIN (Employer Identification Number), the employer’s legal name and address, and the contact information of the person responsible for filing the form. Additionally, you’ll need the employee’s name, address, and social security number, along with the details of the health coverage offered, such as the plan name, the employee’s share of the cost, and the months the coverage was offered or provided.

Step 2: Completing Part I

In Part I, you’ll need to provide the basic information about the employer and the offer of coverage. Start by filling in the employer’s details, including the EIN, legal name, and address. Next, indicate whether the employer is a large or small employer and the month and year the form is being filed. Then, move on to the offer of coverage section, where you’ll need to select the appropriate boxes to indicate the offer of coverage, the months the coverage was offered, and whether the offer was affordable and met the minimum value requirements.

Step 3: Part II - The Health Coverage Details

Part II is where the specifics of the health coverage come into play. Here, you’ll need to provide details for each employee, including their name, social security number, and the months they were enrolled in the coverage. You’ll also need to indicate the plan type, the employee’s share of the cost, and whether the plan provides minimum essential coverage. This section requires careful attention to detail, as any errors here could lead to significant compliance issues.

Step 4: Certifying the Information (Part III)

Part III is a critical step, as it involves the employer certifying the accuracy of the information provided. Here, the employer or their authorized representative must sign and date the form, taking responsibility for the truthfulness of the information. This section also includes a reminder to keep a copy of the form for their records and to provide a copy to each employee.

Additional Considerations

It’s essential to note that the 1095-C form is just one part of the larger healthcare reporting requirements. Employers should also be familiar with the 1094-C transmittal form, which provides summary information for all the 1095-C forms filed. Additionally, employers must ensure they are providing accurate and affordable coverage to their employees, as failure to do so could result in significant penalties.

Common Misconceptions

One common misconception is that the 1095-C form is only relevant for large employers. In reality, all employers with at least 50 full-time employees or full-time equivalent employees are required to file this form. Another misconception is that the form is only needed for employees who are enrolled in the coverage. However, the form is required for all employees, regardless of their enrollment status.

Expert Insights

According to tax expert, Emily Parker, “The 1095-C form is a complex document, but with careful attention to detail and a thorough understanding of the requirements, it can be completed accurately. Employers should not underestimate the importance of this form and should ensure they are providing the necessary information to their employees.”

Conclusion

Unraveling the intricacies of the 1095-C form is a critical task for employers. By following this step-by-step guide and paying close attention to the details, employers can ensure compliance with the Affordable Care Act’s reporting requirements. Remember, accurate reporting not only helps employers avoid penalties but also provides employees with valuable information for their tax obligations.